General Liability Insurance

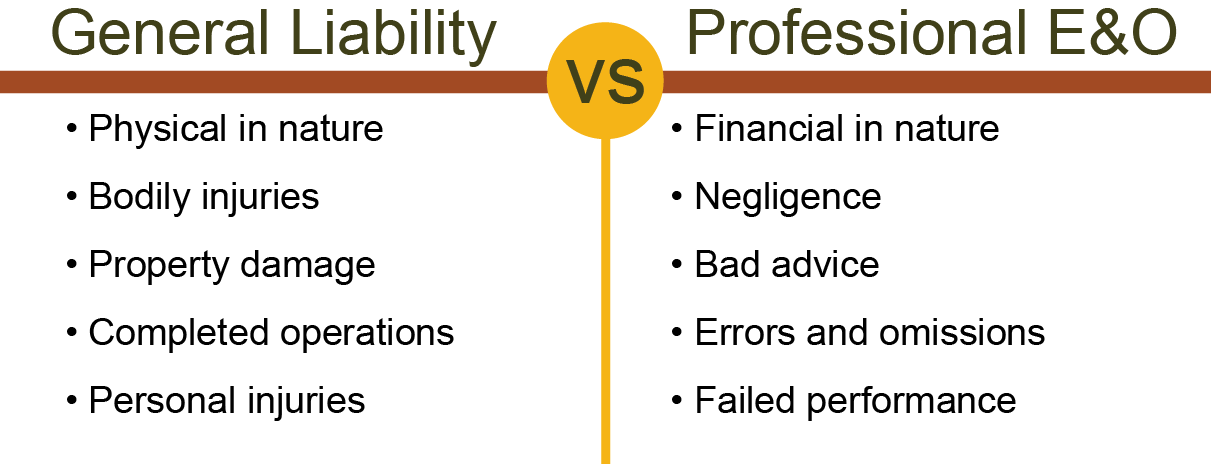

General liability coverage responds to claims of bodily injury or property damage. These policies include coverage for injury and damages caused by the work performed or completed products by the insured. GL insurance has a physical element to it because the liabilities covered are physical in nature. General liability coverage does not include coverage for negligence.

Professional Liability Insurance

Professional liability coverage differs from general liability in that it pertains to negligence associated with professional services rendered. Damages paid under a professional liability policy are typically financial rather than physical. These damages could result in receiving bad advice from a professional or due to the failure of a service.

For example, a technology consultant could cause financial damage to a customer by programming a software program that does not perform as promised. An attorney could cause a client to lose a lawsuit because they were not competent in a particular area of the law or inaccurately advised their client on a legal matter. Even though noone was physically hurt and no physical damage was done, the third-party or customer may have a legal claim against the insured.

Professional liability insurance covers the costs of judgments, settlements and legal defense.

Professional liability insurance is also commonly known as errors and omissions insurance (E&O). It’s also synonymous with professional indemnity insurance and medical malpractice insurance. Depending on your industry, one terminology may be more prevalent. An important part of professional liability coverage is that it generally includes some or all legal defense costs for defending an insured as well as paying damages awarded in a civil lawsuit.

The most common professions who need professional liability insurance include medical professions, information technology fields, accounting, legal professions, financial services fields, non-profit roles, consultants, brokers and insurance agencies.

Does a Business Need Both?

Adding GL Coverage to a Professional Liability Policy

Traditionally, business owners had to purchase two separate policies for their business. Today, companies that purchase professional liability insurance often have an option to have general liability coverage endorsed onto their professional liability policy. This method is typically less expensive than purchasing two separate liability policies. This type of policy endorsement often converts the policy to a BOP (Business Owners Policy) and often includes additional coverage beyond GL and professional liability.

Get General Liability and Professional Liability Quotes

For business professionals who need errors and omissions coverage, the primary underwriting consideration and the cost of coverage is heavily weighed on the side of professional liability insurance. These types of businesses are better served by seeking professional liability insurance first, then requesting quote options, GL endorsements and part of the E&O quote.

Commercial Package Policies

A commercial insurance package, or CPP, is a combined policy that includes more than one line of insurance with the same insurance company. An example of a package policy would be a policy including general liability insurance and property coverage. Packages typically come with additional policy credits and discounts on coverage because the insurance company is writing more than one line of coverage for the business.

Another advantage of buying coverage as a package is insurance premium billing. Most insurance carriers that quote CPPs also have payment plans for the entire package as one seamless line of coverage. Commercial insurance packages also help ensure there are no gaps in your coverage caused by the language used in the policy. Most insurance companies have separate policy exclusions and inclusions for each line of coverage. With a CPP, the policy will contain common policy declarations and common policy conditions to help ensure consistency with the coverages.

Commercial insurance packages allow for a great deal of flexibility in purchasing business insurance specifically tailored for each company.

A Commercial Insurance Package can Include:

✓ General Liability Insurance

✓ Professional Liability Insurance

✓ Commercial Property Coverage

✓ Commercial Auto Coverage

✓ Inland Marine Coverage

✓ Machinery and Boiler Coverage

✓ Commercial Crime Insurance

✓ Employment Practices Liability Insurance