A Claims Made Liability Insurance Policy

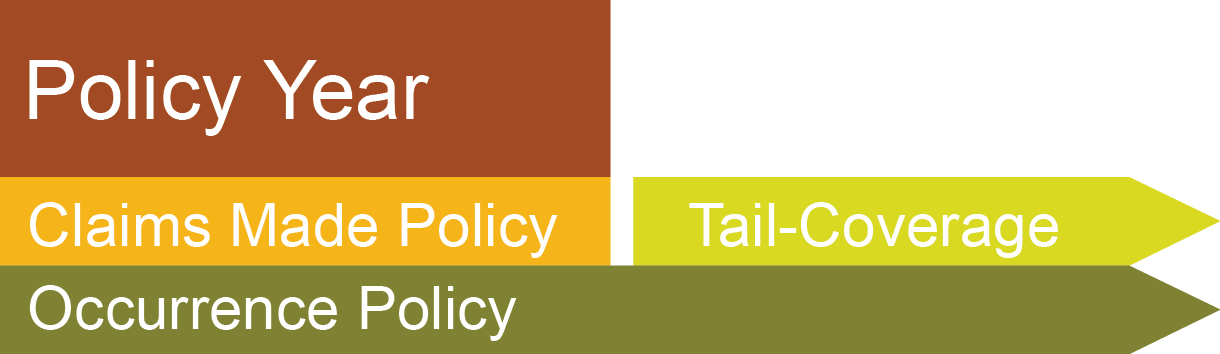

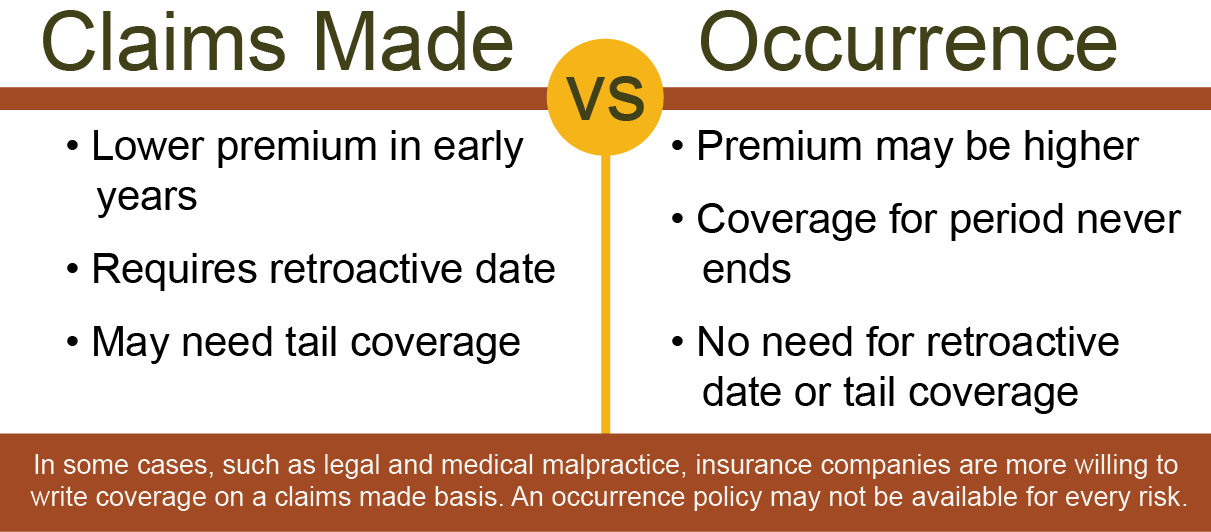

A claims made insurance policy covers insurance claims filed during a given period of time. Generally speaking, a claim must be filed while a claims made policy is still in effect in order for it to be covered by the insurance carrier. This type of policy form is generally less expensive than an occurrence policy as there isn’t any automatic coverage in place once the policy has ended. Business owners who typically purchase claims made with GL or professional liability insurance coverage include contractors, attorneys and medical professionals. The most common types of policies written on a claims made basis include professional liability, directors and officers E&O, as well as employment practices liability insurance (EPLI).

An important consideration with claims made policies is tail coverage. Tail coverage (also known as an Extended Reporting Endorsement) is an additional policy most business owners will need to buy when they decide to retire or exit their business. Otherwise, a claim filed for work done in the past will not be covered under the claims made form. Unfortunately, there isn’t any guarantee an insurance company will write a tail coverage policy and the premium may be expensive depending on prior policy claims.

The Occurrence Policy for Liability Insurance

An occurrence policy provides coverage for losses or claims that are related to a policy term. A claim can be filed years later for a liability caused during a prior period of time as long as there was active coverage in place when the cause of the claim was created. While an occurrence policy form may be more expensive for some types of business, there isn’t any future cost associated with buying tail coverage.

An occurrence policy is the more common from of coverage and a better choice for most business owners. It is more reasonable to have the coverage in place indefinitely for work performed than it is to gamble on finding tail coverage, or avoiding a future claim. In many instances, the additional cost of an occurrence policy form is minimal compared to purchasing a claims made policy.

Why are There Two Types of Policies?

Claims made insurance coverage is more similar to early insurance programs when groups of businesses would form private insurance pools as a means to cover potential losses. As insurance products and companies evolved into an industry, the idea of protecting risks based on a claims made basis followed. The primary reason claims made coverage is still around is because there is a demand and because insurance companies may only be willing to write certain types of risk on a claims made basis.

It is much easier for an insurance company to price insurance premium and measure profitability with claims made insurance forms because there is a clear start and stop date to coverage. With occurrence coverage, it can take decades for insurance companies to measure profit and loss due to the possibility of future insurance claims. In simple terms, a business owner who purchases an occurrence policy for one year will always be insured for any future claims that arise from work done by the insured during that one year term. With claims made coverage, the insured would need to buy additional tail coverage for any future exposure.

Disadvantages of Claims Made Insurance

Claims made policies are more complex than occurrence policies. They require a strong understanding of the policy language used in the insurance contract. Claims made coverage is triggered by the insured’s awareness of potential claims and notification of the claim to the insurance company. Failing to properly notify the carrier can potentially void any coverage.

| Four Claims Conditions Needed to Validate a Claims Made Policy: |

- Insured must become aware of claim, or potential claim, during policy period.

- Insured must report claim, or potential claim, to insurance carrier during policy period.

- Claim cause must be within the claims made policy term, or retroactive date.

- Insured must attest, and certify, they had no prior knowledge of claim prior to purchasing policy.

Retroactive date is typically the beginning date of the first annual claims made policy. Businesses that continue to renew their coverage will generally retain coverage back to the original date of coverage.

Start a Liability Insurance Quote Online

Let our highly trained experts help your business understand the options for business liability insurance. Whether you’re looking for a claims made policy, an occurrence policy or you’re not really sure, our specialists can help you weigh coverage options and help you shop for the most affordable liability coverages for your business.

Start your quote today or give us a call at 800-900-8657 to speak with a licensed insurance agent specializing in commercial liability insurance.

Contractors’ Claims Made Policies

Contractors and construction companies often find themselves with a claims made policy without fully realizing what their policy covers and how it works. The two most common reasons contractors buy claims made policies are 1) they are often less expensive initially than occurrence policies, and 2) they sometimes can’t get general liability quotes on an occurrence policy form.

Contractors are often sold claims made coverage without being informed of the risks and coverage differences.

The fact is that most liability claims against construction companies come long after the policy is terminated. Contractors with claims made coverage that don’t purchase tail coverage (and most do not) are putting their assets at risk once their policy terminates. Additionally, claims made insurance policies tend to get more and more expensive each year as insurance companies pick up more exposure for prior acts from the retroactive date. Finally, contractors who find themselves with a cancelled insurance policy may not be able to find another insurance company willing to offer coverage.

Contractors need to be aware of what type of general liability policy they have and what they are buying from agents. Our agency does not recommend claims made policies for most types of contractors, unless they are fully aware of, and willing to assume, the risks associated with this type of coverage.